Secure Your Possessions With Our Count On Foundation: Offshore Trust Providers

With our Trust fund Foundation's overseas count on solutions, you can rest simple recognizing your possessions are safeguarded. By using our trust fund foundation, you can secure your assets from prospective threats and unpredictabilities. Take advantage of our overseas depend on solutions and gain tranquility of mind recognizing that your hard-earned possessions are in risk-free hands.

The Advantages of Offshore Trusts

Safeguard your wide range and appreciate tax obligation benefits with overseas counts on. Offshore counts on use numerous advantages that can help protect your properties and maximize your monetary preparation. One of the vital advantages of overseas trusts is the enhanced level of possession protection they offer. By transferring your possessions to an offshore jurisdiction, you can shield them from potential lawful cases and creditors. This protection is especially important for individuals who operate in markets susceptible to litigation or face personal liability risks.

An additional significant advantage of offshore trust funds is the capacity for tax obligation optimization. By developing an offshore count on, you can take advantage of tax obligation rewards, exceptions, and reduced tax prices.

Moreover, offshore trusts use flexibility and adaptability in estate planning. trust foundations. With an offshore depend on, you can define exactly how your possessions are to be dispersed upon your fatality, guaranteeing that your dreams are executed exactly. This can be specifically advantageous for people with complex family members structures, international possessions, or problems about probate and inheritance laws in their home jurisdiction

Exactly How Our Trust Fund Structure Functions

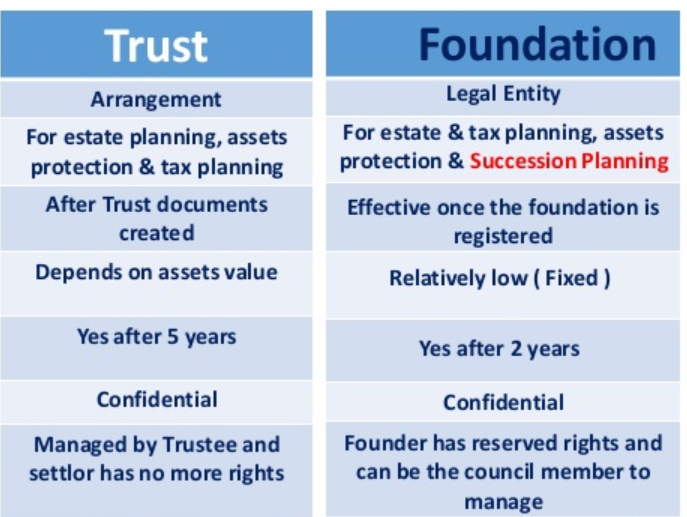

With our Trust Fund Structure, you can efficiently handle and safeguard your possessions via our overseas trust fund solutions. Our Trust fund Foundation works by establishing a lawful entity that holds and manages your possessions in your place. This entity is separate from you as a private, supplying an included layer of defense for your possessions.

To begin, you will require to establish the Trust fund Structure by appointing a trustee, who will certainly oversee the administration of your possessions. The trustee can be a specific or a specialist trustee business, depending upon your preferences and needs.

Once the Trust fund Foundation is developed, you can move your properties right into the trust fund, permitting them to be held and managed by the trustee. This separation of possession supplies countless advantages, consisting of asset security, tax preparation, and estate preparation benefits.

The trustee will act according to the terms and conditions laid out in the count on deed, ensuring that your possessions are managed and dispersed according to your dreams. They will likewise deal with any required administrative jobs, such as record-keeping, tax obligation coverage, and compliance with pertinent laws and guidelines.

With our Trust Fund Foundation, you can have peace of mind recognizing that your possessions are being properly handled and safeguarded. Our overseas trust services supply a personal and safe environment, permitting you to preserve control over your properties while reducing threats.

Key Attributes of Our Offshore Count On Solutions

Discover the special benefits and benefits of our offshore count on services. Our overseas count on solutions offer a series of vital attributes that can assist you shield and grow your assets. Our solutions use boosted privacy and privacy. By establishing a depend on in an overseas jurisdiction, you can ensure that your economic events remain private and protected from spying eyes. In addition, our offshore trust services give property protection. With making use of trust funds, you can protect your riches from possible lenders, suits, and various other legal company website hazards. Furthermore, our services supply tax obligation optimization. By using overseas depend on frameworks, you can take advantage of beneficial tax obligation regulations and decrease your tax obligations. This can result in substantial savings and raised productivity. Our overseas trust fund services also provide versatility and control. You have the capacity to customize the count on structure according to your certain needs and needs, enabling you to keep control over your possessions while still enjoying the advantages of a depend on. Our solutions supply estate preparation advantages. Offshore counts on can be an efficient tool for managing and dispersing your properties to your recipients in a tax-efficient manner. With our offshore trust solutions, you can delight in tranquility of mind recognizing that your assets are safe and secure and your financial goals are available.

Actions to Establish Your Depend On

To establish your depend on, you will certainly need to follow a series of actions that make sure the security and performance of the process. Initially, you need to gather all the essential details and documents required to establish the trust fund. This includes identifying the assets you desire to safeguard, figuring out the recipients, and appointing a trustee who will manage the trust fund in your place.

Following, you will certainly need to select the territory where you intend to establish your depend on - trust foundations. It is vital to select a territory that provides strong possession defense laws and ensures the privacy of your depend on. Our trust structure provides services in different reputable territories, giving you the flexibility to select the one that best fits your needs

When you have actually picked the jurisdiction, you will need to involve with our specialist team to draft the trust fund agreement. This legal record outlines the terms of the trust fund, consisting of the powers and responsibilities of the trustee, circulation provisions, and any kind of specific directions you might have.

After the trust fund contract is drafted, it will require to be implemented and sworn. This step makes sure the legitimacy of the trust fund and its conformity with legal requirements. Finally, you will certainly transfer your possessions right into the depend on, properly putting them under the protection of the depend on framework.

Safeguarding Your Possessions: Trustee Responsibilities

To effectively shield your possessions, the trustee has important duties that their explanation must be fulfilled. As the trustee of an offshore count on, your primary obligation is to act in the very best interests of the depend on beneficiaries. This indicates choosing that will protect and expand the depend on properties for their advantage.

Among your essential obligations is managing the count on possessions reasonably. This includes investing the properties intelligently and expanding the portfolio to lessen threat. You must likewise maintain precise records of all financial deals and give routine reports to the recipients, making sure transparency and responsibility.

An additional crucial duty is to protect the depend on assets from any prospective hazards or claims. This includes taking actions to safeguard against mismanagement, burglary, or scams. You must likewise make sure conformity with all relevant laws and laws to avoid any legal issues that might jeopardize the depend on.

As a trustee, you are additionally liable for making circulations to the recipients according to the terms of the depend on. It is essential to exercise sound judgment and think about the beneficiaries' requirements and scenarios when making these distributions.

Final Thought

By establishing your count on and entrusting it to our experienced trustees, you can have tranquility of mind recognizing that your properties are safeguarded for the future. Begin protecting your assets today with our overseas trust fund services.

With our Trust Structure's overseas count on services, you can relax very easy recognizing your properties are secured.With our Trust Foundation, you can successfully handle and protect your assets with our overseas depend on services. You have the ability to tailor the depend on structure according to your details requirements and demands, allowing you to keep control over your possessions while still delighting in the web link advantages of a count on. You will move your assets right into the count on, properly placing them under the protection of the depend on structure.

As the trustee of an overseas trust, your main duty is to act in the ideal interests of the depend on beneficiaries.